Gujarat Kidney & Super Speciality IPO Details 2025 | Price Band, Dates & Review

Gujarat Kidney & Super Speciality IPO – Price Band, Dates, GMP, Financials & Company Review (2025)

Educational article by Money Bells Research Analyst (SEBI RA – INH100009901)

Gujarat Kidney & Super Speciality – Company Overview

Gujarat Kidney & Super Speciality Limited is a Gujarat-based healthcare services provider operating multi-speciality hospitals with a strong focus on renal care, urology, nephrology, dialysis and critical care services.

The company caters to patients requiring long-term treatment for kidney-related diseases, which makes the business relatively non-cyclical compared to other sectors.

IPO Details

| IPO Type | Mainboard IPO (Book Built Issue) |

|---|---|

| Listing Exchange | BSE & NSE |

| Issue Size | Approx. ₹225 crore |

| Fresh Issue | 2.20 crore equity shares |

| Offer for Sale (OFS) | Nil |

| Face Value | ₹2 per share |

| Registrar | MUFG Intime India Pvt. Ltd. |

| Lead Manager | Nirbhay Capital Services Pvt. Ltd. |

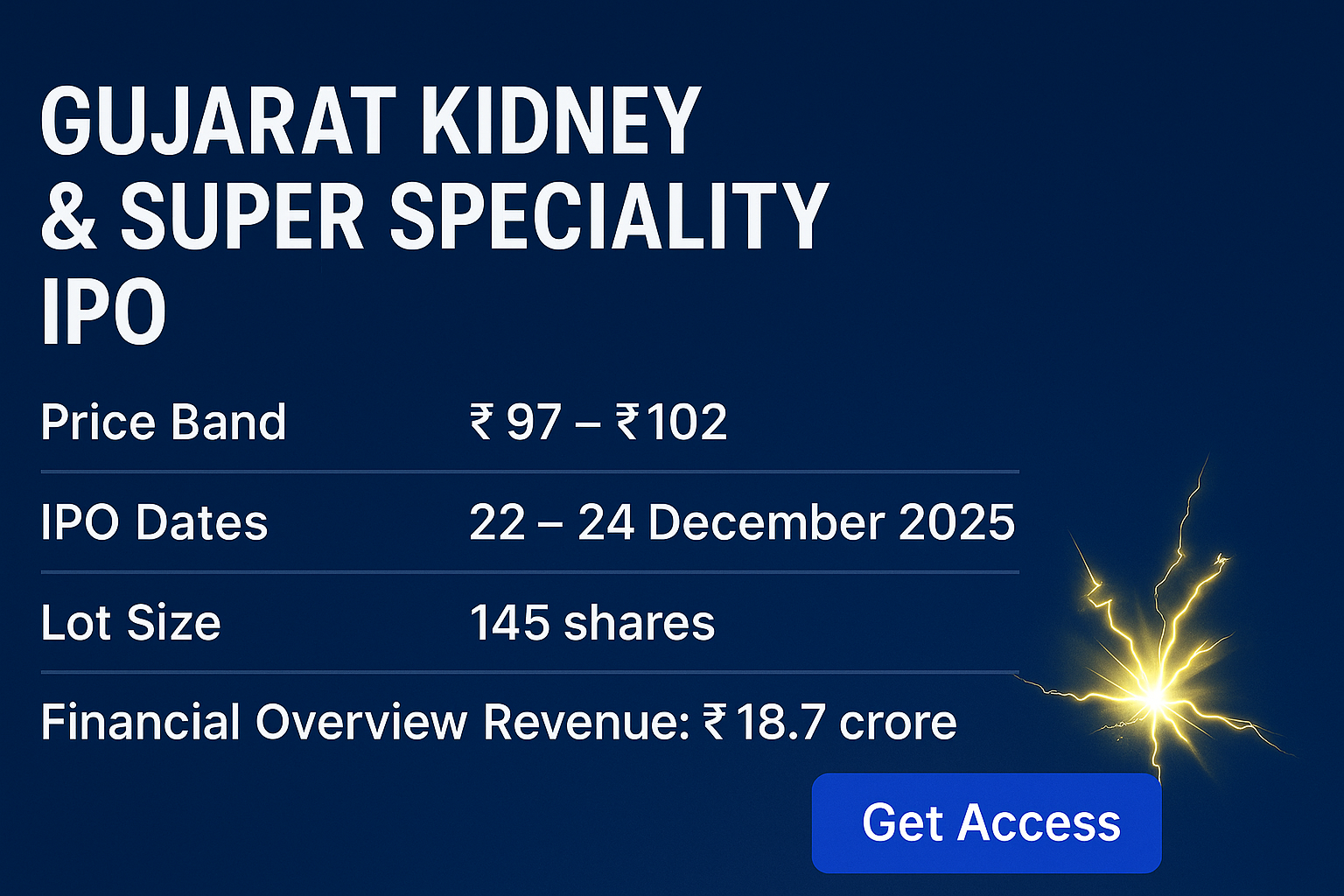

Price Band & Lot Size

| Price Band | ₹97 – ₹102 per share |

|---|---|

| Lot Size | 147 shares |

| Minimum Investment | ₹14,994 (at upper band) |

Important Dates

| IPO Opens | 22 December 2025 |

|---|---|

| IPO Closes | 24 December 2025 |

| Basis of Allotment | 26 December 2025 |

| Refunds / Demat Credit | 29 December 2025 |

| Listing Date | 30 December 2025 |

Use of IPO Proceeds

- Acquisition of existing hospitals

- Capital expenditure for new hospital facilities

- Purchase of advanced medical equipment

- Repayment of certain borrowings

- General corporate purposes

Business Model

The company follows a hospital-based healthcare delivery model and earns revenue from in-patient treatments, dialysis services, surgeries, consultations and diagnostics.

Financial Snapshot

| Revenue (FY24) | ₹18.7 crore |

|---|---|

| Profit After Tax | ₹5.6 crore |

| Total Hospitals | 6 |

| Operational Beds | ~250 beds |

IPO GMP (Grey Market Premium)

As of the latest available data, Gujarat Kidney & Super Speciality IPO GMP is around ₹15–₹18 per share. GMP is unofficial and can change rapidly based on market sentiment.

Growth Drivers

- Rising incidence of kidney-related diseases

- Increasing healthcare spending in India

- Limited organised renal care players

- Expansion of hospital capacity

Risk Factors

- High operating and staffing costs

- Regulatory and healthcare compliance risks

- Dependence on skilled medical professionals

- SME-to-mainboard transition execution risk

⚠️ Apply karne se pehle FREE Trade Reports zarur check karein.

Investor Checklist

- Price band & valuation samjhein

- Healthcare sector risks evaluate karein

- Sirf GMP ke base par decision na lein

- Portfolio diversification zaruri hai

Disclosure (SEBI Compliance)

Important: This article is for educational purposes only.

Money Bells Global Research Services Pvt. Ltd. is a SEBI Registered Research Analyst (INH100009901). No buy or sell recommendation is made. IPO investments are subject to market risks. https://moneybells.in/resources/disclosure

Please read the Red Herring Prospectus carefully before investing.

.jpg)